Postponement of due dates for withholding tax and payroll tax

As a part of the Covid-19 Relief for businesses as a response to the economic effects of the coronavirus pandemic, employers may apply for a postponement of up to three payments.

These must be due to deducted withholding taxes on wages and payroll taxes with a due date from 1 April up to and including 1 December 2020.

The postponement of due dates and final due date payments may be requested to 15 January 2021 on the fulfillment of certain conditions.

If an employer who has postponed payments in 2020 suffers significant loss of income in 2020 compared to earlier operating years, he can request further postponement and distribution of the payments that have previously been postponed, until the 15th day of the months June, July and August 2021. Additionally the postponed payments of half the deducted withholding taxes on wages and payroll taxes for February 2020 may also be postponed further.

Further postponement and payment distribution must be applied for from Iceland Revenue before 15 January 2021

Conditions for postponement

Operating difficulties

The employer suffers significant operating difficulties during 2020 due to the sudden and unforeseen loss of income that results from a national and international general downturn.

More detailed information on the conditions in question are discussed in the committee opinion of the Economic Affairs and Trade Committee regarding the matter.

The significant operating difficulties criterion is not considered fulfilled if dividends are allocated or own shares are purchased in 2020 or if the withdrawals of owners within 2020 exceed their calculated remuneration.

No arrears with public charges and reporting

The employer may not be in arrears with public charges, taxes and tax fines which had a final due date of 31 December 2019, and levied taxes and charges may not be based on estimates due to defaults of tax returns and reports, including PAYE (pay-as-you-earn) returns and VAT tax reports to Iceland Revenue, for the past three years.

The application for postponement must be submitted to the Iceland Revenue in good time

The employer must have applied for postponement of returns on the service pages of Iceland Revenue no later than on the final due date of the payment period in question (application submitted). The application shall be accompanied by a declaration from the employer to the effect that the conditions of the postponement are met. Postponement applications can be submitted on the service website of Iceland Revenue. The payer uses the application form to select the dates on which he wishes to postpone due date payments and declares, by selecting the appropriate field, that he believes that he fulfils the conditions of the provision for postponement. The tax authorities may specifically request that the applicant show, by means of reasoning and data, that there are significant operating difficulties, such as with reference to the decrease in VAT-liable turnover, and that the conditions of the provision for postponement are in other respects met.

The application must be submitted at the very latest on the final due date of the payment period in question. It is possible to apply for postponement of up to three due dates. The application applies both to the postponement of deducted withholding tax and to the payment of payroll taxes. No application for postponement can be submitted if the final due date has passed.

- Example: Application relating to due date on 1 April must be submitted at the latest on 15 April.

Iceland Revenue may reject your application for payment postponement if it is of the opinion that the requirements are not met.

The postponement of withholding taxes does not apply to public bodies, i.e. entities that exercise state or municipal powers, and does apply to the payment of taxes according to the Act on Financial Management Tax No. 165/2011.

Attention is brought to the fact that the tax authorities' processing of the payment postponement does not mean that its conditions have been met on the date of processing.

Periodic declaration reports on withholding tax must be submitted in the same manner as before. The payment postponement does not include any postponement of periodic declaration reports according to the Act on Public Dues Withheld at Source.

Surcharge on withholding tax

In the event that an examination by Iceland Revenue of the application subsequently reveals that the conditions for payment postponement were not met, the employer shall be subjected to a surcharge in addition to the amount of the due payment in accordance with the original due date and final due date of each payment for which payment was postponed. The employee and his representatives shall not be subjected to further penalties.

Postponement of payments to summer 2021

If an employer who has postponed payments in 2020 suffers significant loss of income in 2020 compared to earlier operating years, he can request further postponement and distribution of the payments that have previously been postponed, until the 15th day of the months June, July and August 2021. Further postponement and payment distribution must be applied for from Iceland Revenue before 15 January 2021. When processing the application, Iceland Revenue shall, among other things, take account of the VAT returns of the applicant in 2020 and the scope of the operation in other respects.

Application instructions

A web-based solution has been prepared for applications for the postponement of payments of withholding taxes and payroll taxes. Below are instructions on how to apply for the postponement.

Services website log-in

The first step is to register into the services website of Iceland Revenue using electronic ID, withholding tax password or permanent main web key.

A box such as the one shown here should appear for most employers on the front page of the service website after registration.

Finding the application in the menu

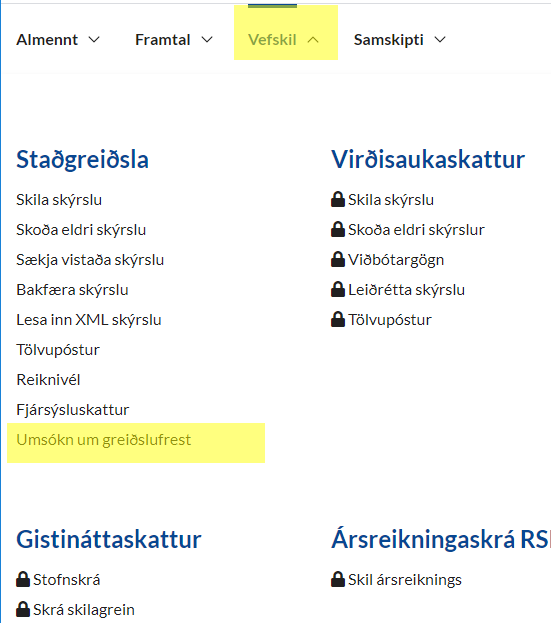

The application can also be found in the menu under Vefskil > Staðgreiðsla > Umsókn um greiðslufrest (Web returns > Withholding tax > Application for payment postponement).

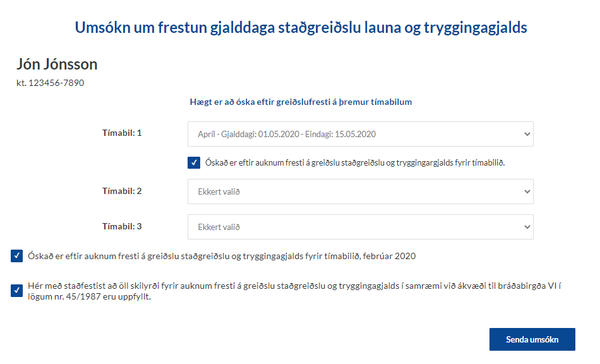

Application for postponement

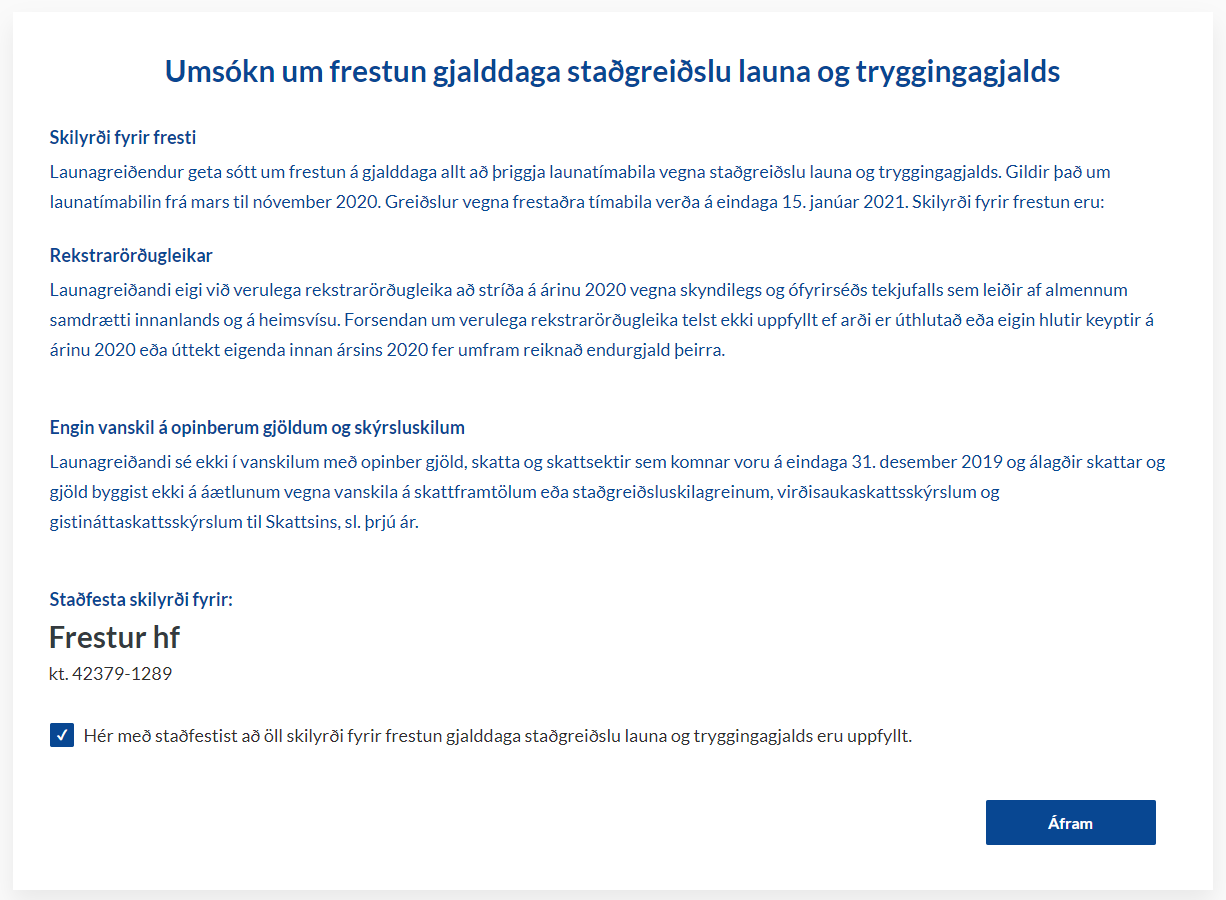

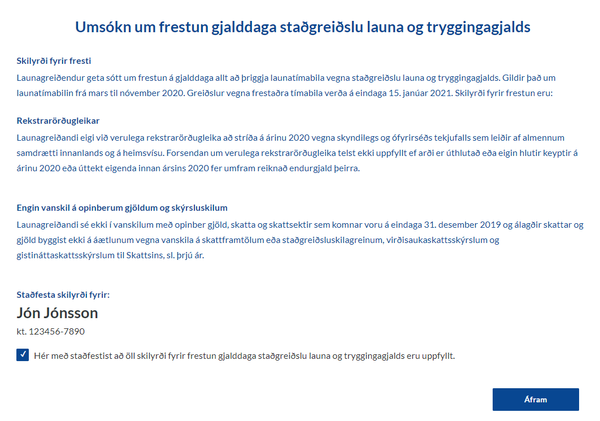

The application is in two parts.

The first reviews the conditions that must be met to postpone payments, and the name of the employer is displayed to avoid misunderstandings.

Select the appropriate fields indicating that all conditions for postponement have been met.

Does not meet requirements

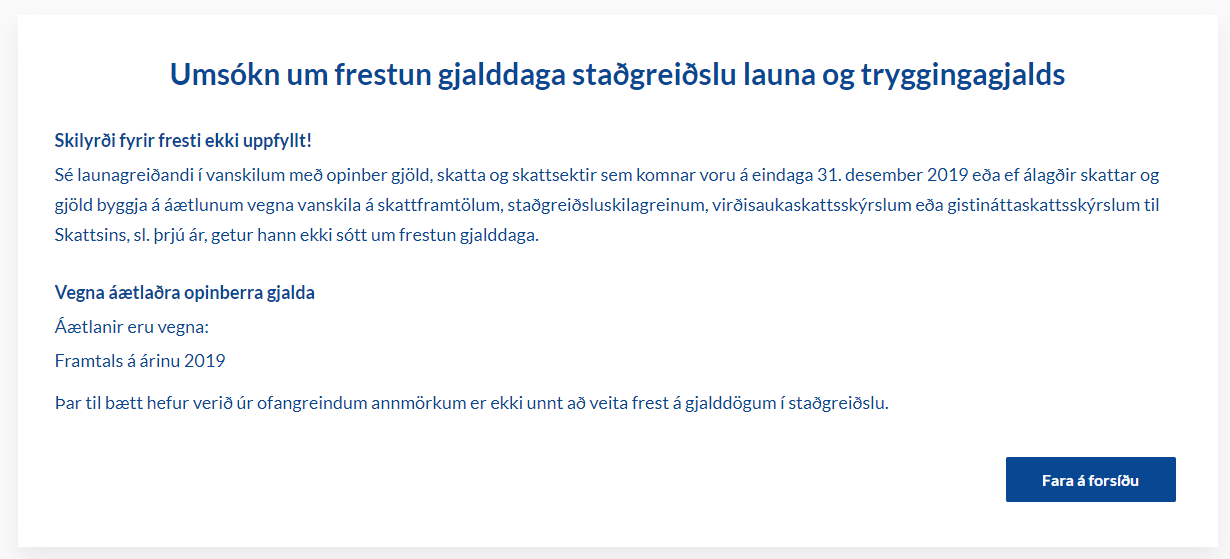

After the applicant has indicated that all requirements have been met, an examination is made of whether he is in arrears with public levies and whether they are based on estimates. If the employer owes a significant amount in public levies or has not submitted the mandatory periodic declaration reports during the past three years, the employer will be directed to this page where he is advised to remedy the situation before continuing.

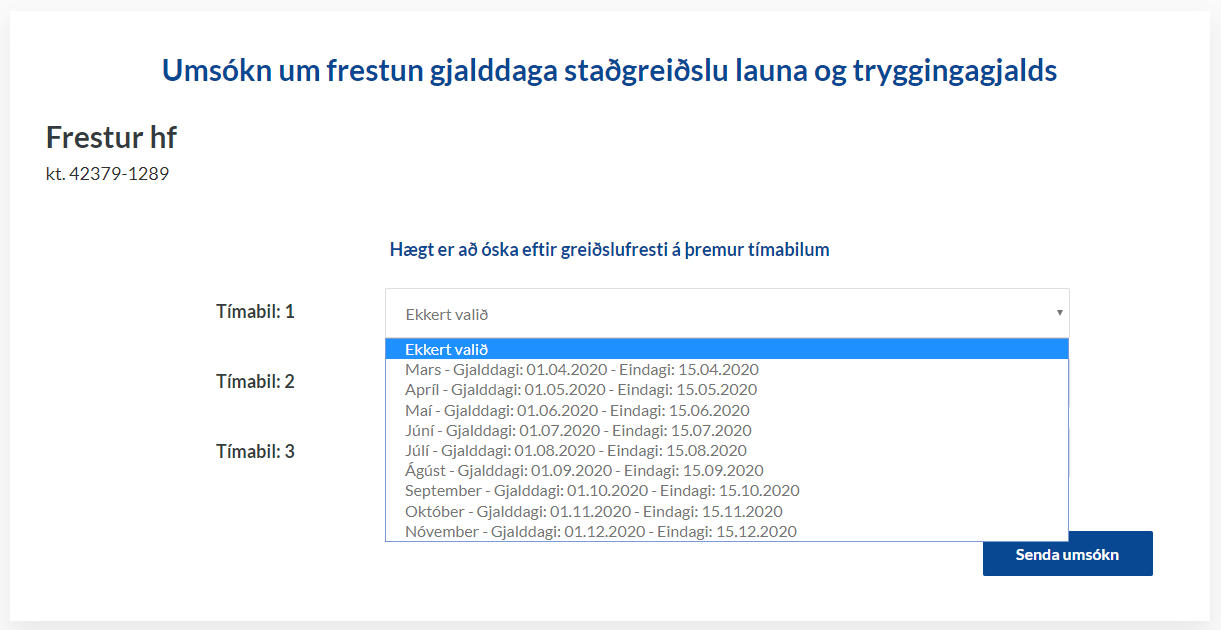

Selecting a period

The three periods for which postponement is requested are selected in step two.

You can select all three periods immediately or simply select one or two to begin with. It makes no difference whether an employer applies for postponement before or after returns during a period, so long as the application is submitted before the final due date.

The application can be changed after it has been submitted up to the final due date of the selected period.

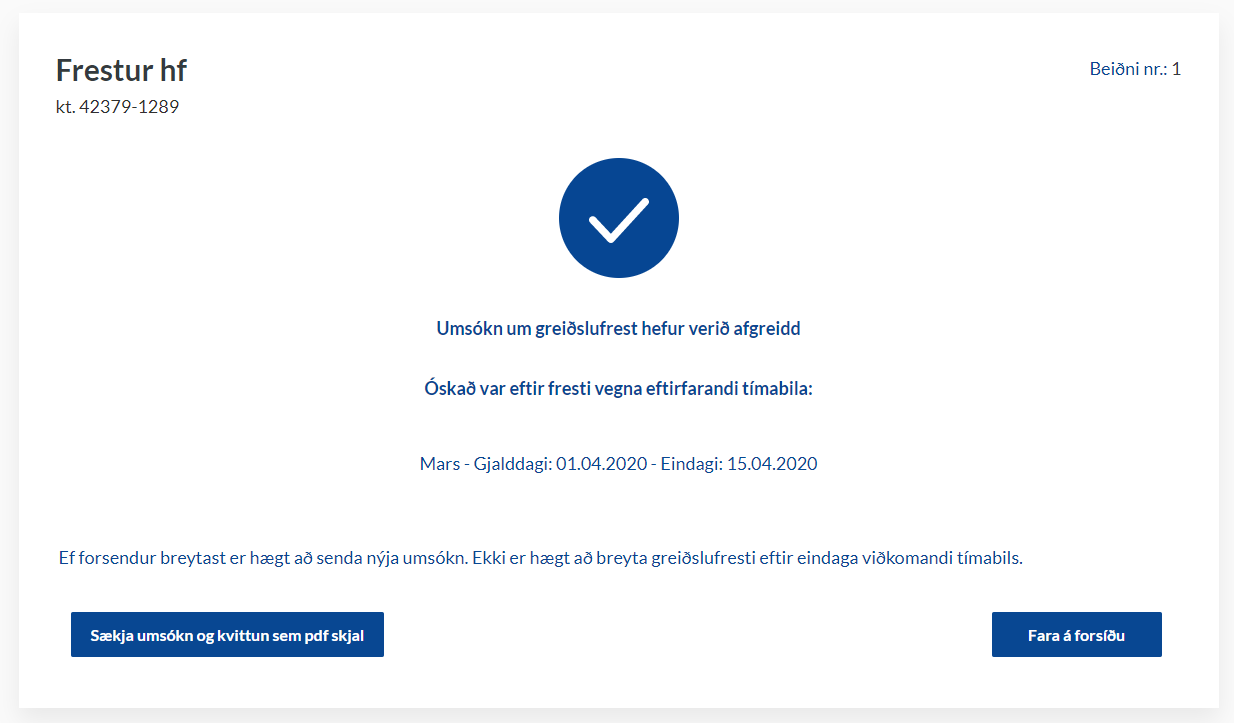

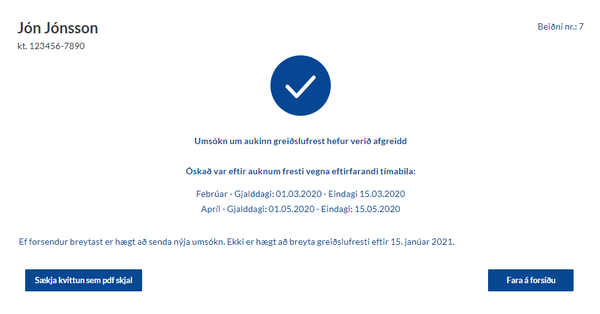

Confirmation as PDF document

After submission, the applicant will receive a receipt. Clicking on the button “Sækja kvittun sem pdf skjal” (get receipt in .pdf) transfers the applicant to a communications website where the receipt is stored.

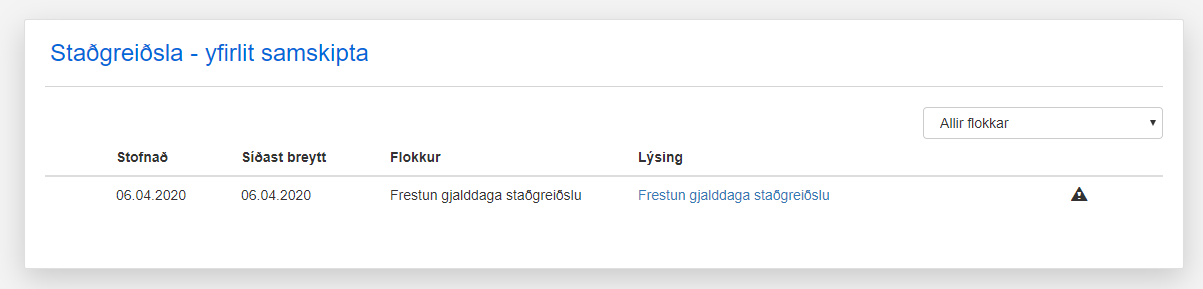

Confirmation on communications page

The communication page contains all receipts for submitted application, i.e. the application history and information about any changes made.

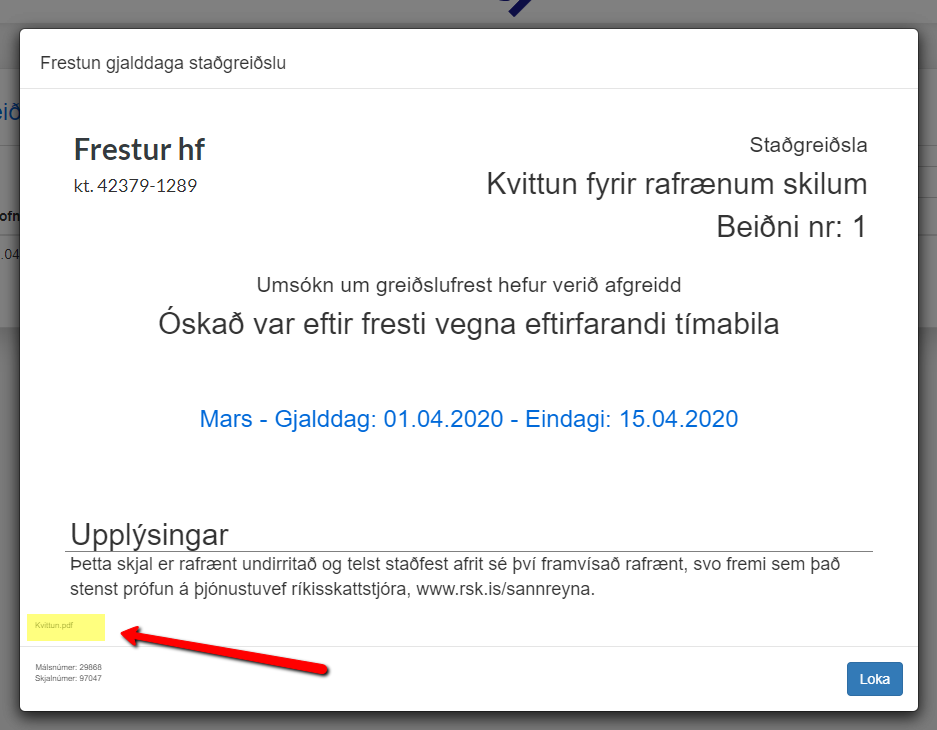

Getting a receipt from the communications website

When the receipt is opened, the application may be retrieved in a .pdf document stamped (electronically signed) by Iceland Revenue.

The origin of the document from Iceland Revenue may be verified on skatturinn.is/sannreyna.

Instructions on extended postponement

If an employer who has postponed payments in 2020 suffers significant loss of income in 2020 compared to earlier operating years, he can request further postponement and distribution of the payments that have previously been postponed, until the 15th day of the months June, July and August 2021. Additionally the postponed payments of half the deducted withholding taxes on wages and payroll taxes for February 2020 may also be postponed further.

Apply before 15 January 2021.

Application for postponement

The first step is to register into the services website of Iceland Revenue using electronic ID, withholding tax password or permanent main web key.

A box should appear for most employers on the front page of the service website after registration. The application can also be found in the menu under Vefskil > Staðgreiðsla > Umsókn um greiðslufrest (Web returns > Withholding tax > Application for payment postponement).

When the application is opened the employer first needs to confirm that the conditions have been met.

To apply for an extended postponement

Employers who have applied for an postponement until 15. January 2021 can now apply to extend that postponement until summar 2021.

Check the appropriate boxes and press the "senda umsókn" button.

The application can be changed up until 15. January 2021, but no changes can be made after point in time.

Application confirmation as a PDF-document

Once the application has been submitted a confirmation appears. By pressing the button "Sækja kvittun sem PDF skjal" one can download the confirmation as a PDF-document. The confirmation will also be saved on the communications page of the website.