How to read the tax assessment results

Tax assessment

The results of the assessment of individuals in 2024 for income year 2023 are now available. Credits will be paid out on May 31st and employers will be notified of debts to deduct from wages.

The tax assessment is when the previous year's tax is settled. Additionally annual fees are charged, those are The Icelandic National Broadcasting service (útvarpsgjald) and The Senior Citizen's Construction Fund.

Log in to see your tax assessment results

Credits will be paid out on May 31st

Credits are deposited into the bank account registered with the debt collectors. If there is no information about a registered bank account, you can register a new one or change a previous one on the Tax service website.

Debts

Debt after assessment is divided into seven due dates. Debt collection goes through payroll at each employer. They are sent a request to deduct a debt from the salary each month.

Make a payment plan and pay over a longer period

If you wish to lower the monthly payments you can divide the debt into smaller payments using the self-service option on Ísland.is. The whole process is available in English. Alternatively contact the tax collector in the area where you live.

A payment plan is made to reduce the monthly payments, but this is offset by higher interest costs in the long run.

Learn more about payment plans

Collection from self-employed persons and people not in work

Those who are not employed or are self-employed are sent a claim for the collection of taxes after assessment.

Questions and answers

How do I log in?

The assessment results are available by logging into Skatturinn's website. You need to use an electronic ID or the Skatturinn password (veflykill) to log in. It is possible to order a password and have it sent to your online bank. The use of electronic credentials is recommended as a more secure login.

Log in to see your tax assessment results

The assessment result is not correct, what do I do?

The result of an assessment can be appealed by submitting a request for correction. After logging in, select "Framtal" and "Beiðni um leiðréttingu". There you can write a summary of the subject that needs correction in the tax return and send additional documents to support your case.

I have not filed my tax return - what do I do?

The tax return form is still available on the service website for those who have yet to file theirs. Simply log in to the service website with an electronic ID or password and submit the return. The report will then be considered as a complaint, and you will be sent a letter when the results are ready.

Why do I owe taxes?

That is not easy to answer. Most people must pay the Icelandic National Broadcasting Service fee and a fee for the Senior Citizens construction fund. If you owe more than that, review these common reasons for tax debt.

- Personal discount overused, or tax paid in the wrong tax bracket, e.g. due to payments from more than one employer.

- Incidental contractor payments.

- A grant against which no deductions have been made.

Information about personal tax credit

Information on tax brackets in 2023

I owe taxes, can the payment be negotiated?

Yes, it is possible to make a payment plan and reduce the monthly payment burden.

Self-service payment plans can be completed at island.is if certain conditions are met.

Application for a payment plan

What bank account does my refund go to?

Refunds are deposited into the registered bank account. If information about a bank account has not been provided, it is simple to enter it on the Tax service website www.skattur.is.

Instructions in English

Final assessment takes place on the basis of the tax return in the end of May the year following the tax year. To find your own personal tax assessment log on to www.skattur.is with your password or electronic identification. Instructions on how to read the tax assessment are available.

Click the picture below to open the instructional video. Subtitles in english are available.

Skoða myndband á YouTube (opens in a new browser tab)

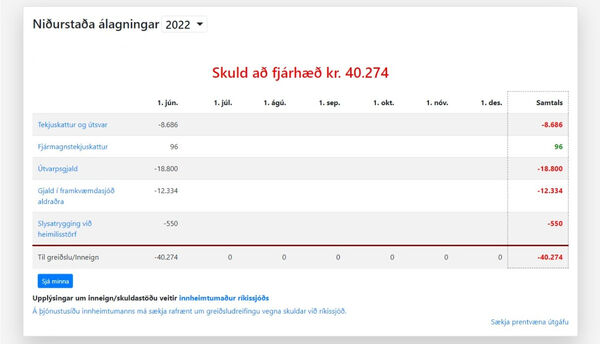

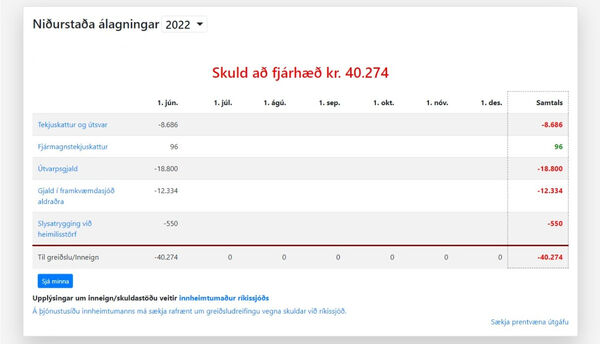

When the results of the public dues levy are opened, you will see whether any amount is due or whether you are entitled to a refund displayed at the top. Debts are readily identifiable, as they are in red and have a minus symbol, while credit is displayed in green.

The amount shown at the top is the total result of the public dues. Click the line labelled “til greiðslu/inneign” (due/refund) to see the settlement of individual payment dates. The amount of some dues are divided between several due dates for payment. Some may need to effect payments on later due dates despite having received a refund on 1 June.

Payment of credit and collection of debts.

Credit is paid out on June 1st. Note, however, that child benefits are divided into two payments.

Income tax and local tax debts are automatically divided into 7 due dates. Payments may be distributed over a longer period by negotiating a payment plan or settling the debt over a shorter period.

As a rule, the collection of debts is carried out by employers (wage payers), who are responsible for deducting the requisite amount from wages.

Self-employed individuals and those who are unemployed will receive a payment note and a claim to their online banking account.

Credit shall be set-off against any overdue claims. Please note that the setting-off authorization applies to jointly taxed spouses as regards public duties and municipal fees. Special child benefit bonuses are not set-off nor are child benefits except in the case of overpaid child benefits.

Examining calculations and criteria

Examining calculations and criteria

You can click on each line to open an information pane to see the manner in which each result has been calculated.

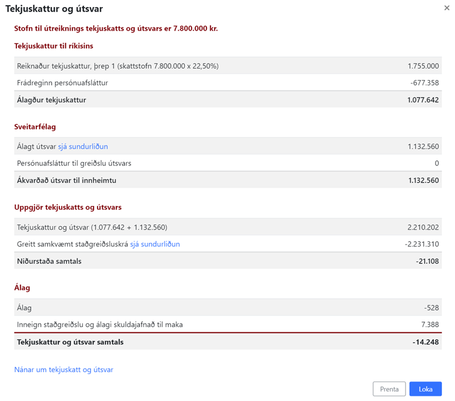

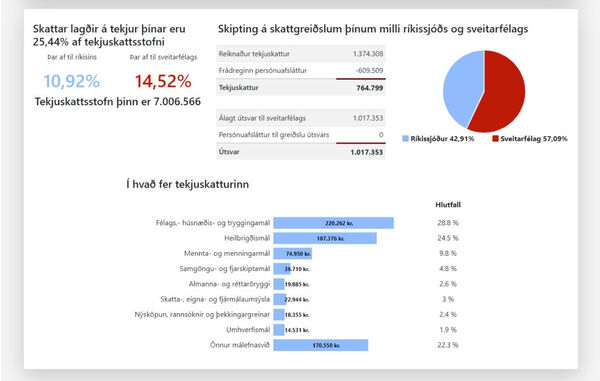

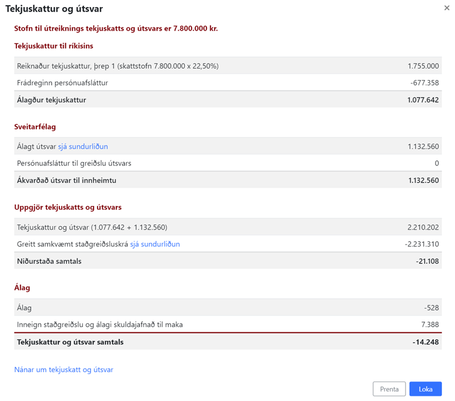

Income tax and municipal tax

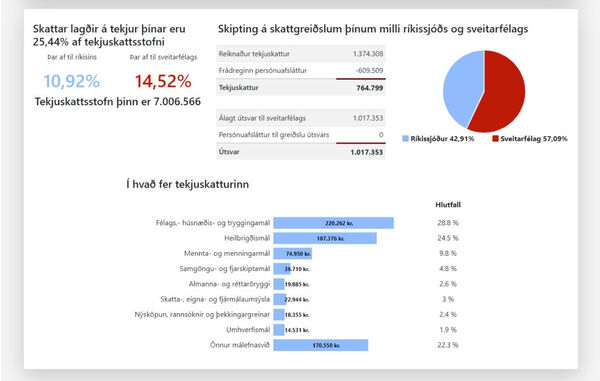

If you click income tax and municipal tax, you will be able to see the manner in which income tax is calculated according your recorded income in your tax return.

In addition, you will be able to see how much municipal tax you pay to your municipality.

The tax paid out by your employer during the year is deducted from your calculated income tax and municipal tax.

In the event of any difference, such amount will be refunded or collected on settlement. A debt may form if e.g. the municipal tax in your municipality is higher than the average municipal tax collected from the withholding tax or if your personal tax credit has been set too high.

Comparable information can be obtained for all taxes and dues that are levied.

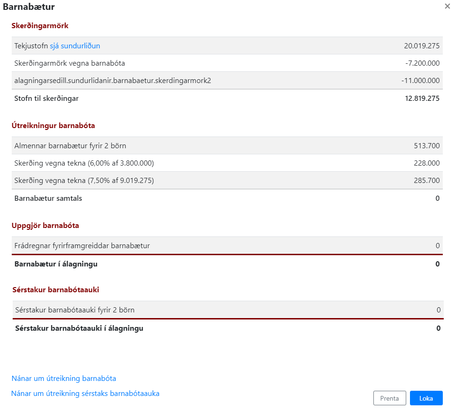

Child benefits

If you click on the information pane for child benefits, you will be able to see the criteria used to calculate the amount and what effects your income has on such calculations.

An extended payment plan

Payments may be distributed over a longer period by negotiating a payment plan. By clicking the link below the tax assessment results an online application form at Ísland.is can be opened and an extended payment plan can be negotiated.

Division of tax payments between the state and municipality

The page contains a pictorial representation of the manner in which the taxes levied on your income are divided between the state and your municipality.

Instrukcje w języku polskim

Gdy wyświetlą się naliczone opłaty (niðurstaða álagningar), na samej górze zobaczysz informację, czy masz niedopłatę (skuld), czy nadpłatę (inneign). Niedopłaty są oznaczone kolorem czerwonym i znakiem minus, a nadpłaty kolorem zielonym.

Kwota, która pojawia się na samej górze, to ostateczny wynik obliczeń. Kliknij wiersz „niedopłata/nadpłata”, żeby sprawdzić podsumowanie każdego terminu płatności z osobna. Niektóre kwoty są podzielone między kilka terminów płatności. Niektóre osoby mogą więc być zmuszone zapłacić w późniejszych terminach, mimo że otrzymały wypłatę nadpłaty 1 czerwca.

Wypłacanie nadpłaty oraz windykacja niedopłaty

Nadpłata jest wypłacana 1 czerwca. Prosimy zauważyć, że zasiłek na dziecko jest wypłacany w dwóch transzach.

Niedopłaty podatku dochodowego i lokalnego są automatycznie rozkładane na 7 terminów płatności. Możliwe jest zarówno rozłożenie płatności na dłuższy okres przez ustalenie indywidualnego harmonogramu płatności, jak i spłacenie długu przed terminem.

Windykacja niedopłaty odbywa się w większości przypadków przez pracodawców, którzy powinni odliczać odpowiednią kwotę od pensji.

Samozatrudnieni oraz osoby niepracujące otrzymują rachunek oraz wezwanie do zapłaty na konto internetowe.

Nadpłaty muszą być odliczone od nałożonych wezwań do zapłaty. Zwraca się uwagę na możliwość wyrównania długów przez małżonków rozliczających się wspólnie, jeśli chodzi o opłaty sądowe i samorządowe. Specjalny dodatek do zasiłku na dziecko (barnabótaauki) ani też sam zasiłek na dziecko nie podlegają wyrównaniu, poza wyrównaniem do nadpłaconego zasiłku.

Przeglądanie wyliczeń i podstaw

Przeglądanie wyliczeń i podstaw

Można kliknąć w każdy wiersz z osobna, aby otworzyć kartę informacyjną, w której wyszczególniono, skąd wziął się określony wynik.

Podatek dochodowy (tekjuskattur) i lokalny (útsvar)

Po wybraniu pozycji Podatek dochodowy i lokalny można sprawdzić, w jaki sposób oblicza się podatek dochodowy na podstawie dochodów podanych w rozliczeniu podatkowym.

Możesz sprawdzić, jak wysoki podatek lokalny płacisz na rzecz swojej gminy.

Podatek zapłacony przez twojego pracodawcę w ciągu roku jest odliczany od obliczonego podatku dochodowego i lokalnego.

Jeśli zachodzą różnice przy wyliczaniu należnych opłat, zostaną one wypłacone jako nadpłata lub przekazane do windykacji jako niedopłata. Dług może powstać np. w przypadku gdy podatek lokalny w twojej gminie jest wyższy niż przeciętnie przewidziany przy pobieraniu zaliczek na podatek lub jeśli osobisty upust podatkowy został nadmiernie wykorzystany.

Podobne informacje można uzyskać o wszystkich podatkach i opłatach uwzględnionych przy wyliczaniu należnych opłat.

Zasiłek na dziecko

Zasiłek na dziecko

Na karcie informacyjnej dot. zasiłku na dziecko można sprawdzić, na jakich podstawach jest on wyliczany i jaki jest wpływ dochodów na wyliczenia.

Podział podatków między państwo a samorządy

Na stronie przedstawiono w formie graficznej, w jaki sposób płacone przez ciebie podatki są podzielone między państwo oraz gminę.